Why link Dext to an accounting software?

Simply put, integrating an account will ensure that all data extraction will be done in a format that matches your existing financial records. To integrate your Dext Prepare account, navigate to the 'Integration' section under 'Connections' and click 'Choose Software'. Follow the on-screen instructions to complete the integration process.

You can find out how to integrate your Dext Prepare account with the following list of software by clicking on the links to find out more:

- Xero

- Xero Cashbooks/Ledger

- QuickBooks Online

- QuickBooks Desktop §

- MYOB AccountRight

- MYOB Essentials

- Sage Business Cloud Accounting

- Sage 50 §

- Kashflow

- Twinfield *

- FreeAgent *

- Iris OpenBooks *

- WorkFlow Max *

- Gusto *

- Bill.com *

Software marked with * are only available on Dext Prepare Business Plus and Premium Accounts and Streamline and Optimize Partner Accounts. Software marked with § please contact our in-house Client Digital Support via Bradley@lwaltd.com to find out how to integrate using Dext Connect as certain regional restrictions apply.

How To Set Up Your Category List (Chart Of Accounts)

Applying the correct nominal code to your purchases and expenses is an essential part of accounting. Dext Prepare makes it easy to set up your Chart of Accounts, whether you’re working with a cloud or desktop accounting solution. In Dext Prepare we refer to each section of your Chart of Accounts as 'Categories'. You can set them up differently depending on if you're using the application with an integrated accounting software. Learn how to set up your Category Lists:

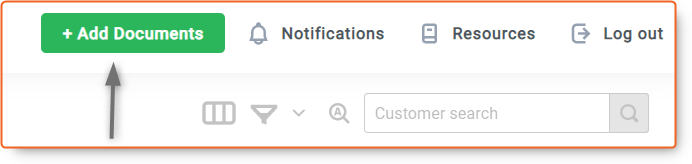

How to Add Documents to Dext

To add any new documents to your Dext Prepare account just click the green '+ Add Documents’ button at the top of the page.

The new Add Documents panel will appear on the right hand side of your screen and you can choose whether you’d like to upload a document to the Costs, Sales or Bank workspace of your account regardless of which workspace you have open.

How to add items to Dext Prepare

The normal Dext Prepare submission methods are all available to Client Account Users and are each useful in different situations:

Mobile: Best for capturing physical, paper documents. There are multiple camera modes on the mobile app so that any format/combination of documents can be captured at once.

Email-in: Best for capturing digital documents. If you’ve received a receipt or invoice through email, it’s probably best to submit this to Dext Prepare using your Email-in address.

Direct Upload: Best for submitting a large batch of scanned receipts or invoices, or a ‘shoebox’ of physical documents.

Invoice Fetch: Best for retrieving digital receipts or invoices, where you would normally have to log in to your supplier’s website and download your bill. This will allow Dext to go to your supplier such as BT, British Gas etc and pull the invoice from their side straight into Dext or straight into Xero. Contact us to set this up directly, as we'll need your login credentials to authorise the Fetch collection with Dext.

Here's what our clients have to say!

“I cannot thank Bradley at LWA enough! Up to a few weeks ago, I would spend hours going through my business expenditure by entering each receipt and invoice into Xero, paying them off and sending out manual remittances to my suppliers. After a short session with Bradley on setting up Dext and showing me how to use it for my business needs, I can now sync with Xero for easy reconciliation and can send out multiple remittances for invoices. It’s amazing that I can have everything done within a quarter of the time it used to take me!”

Daniel Fisher

OD's Designer Clothing

Let us help you save time for your business!

The team at LWA are here to guide you and help ensure you and your business comply with HMRC’s new ‘Making Tax Digital’ (MTD) legislation. If you are concerned and would like to speak to one of our friendly experts, please contact us in Manchester on 0161 905 1801 or in Warrington on 01925 830 830.

Our inhouse Digital Support expert, Bradley Allen-McKenna is available to help you get set up on Xero and Dext to meet your MTD obligations – it takes minutes to set up and Bradley is on hand to guide you through the easy-to-use cloud accounting software. Email bradley@lwaltd.com to find out more.